We’re proud to announce that Lifefram Foundation has received our tax-exempt status from the Internal Revenue Service (IRS) in the U.S. under the Internal Revenue Code (IRC) Section 501(c)(3). Now, our donors can deduct the contributions they make to us under IRC Section 170.

We are a public charity organization under Section 509(a)(2), a subset of 501(c)(3), that receives substantial operating revenues from a combination of contributions, membership fees, and gross receipts from activities that further our exempt purpose which is to archive and maintain the knowledge of people who lived in this world for over 300 years.

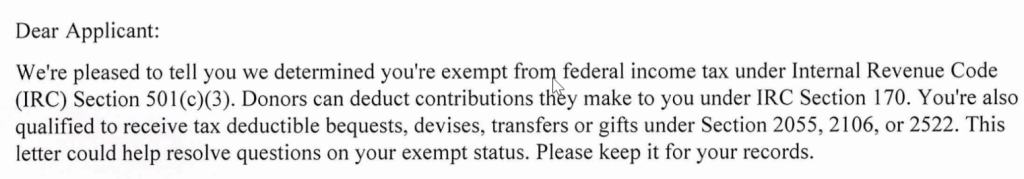

Below is a snippet from the letter we received from the IRS on August 6, 2024, confirming our new status.

To search for our tax-exempt organization on the IRS website, go to https://apps.irs.gov/app/eos and enter our EIN number 98-1798525.

We hope with this new horizon, we can offer more reasons for future donors to contribute to our cause. Because knowledge should last forever, including the knowledge of us.